modified business tax return instructions

Modified Adjusted Gross Income MAGI in the simplest terms is your Adjusted Gross Income AGI plus a few items like exempt or excluded income and certain deductions. The MBT replaces the Single Business Tax effective January 1 2008.

Effective July 1 2019 the tax rate changes to 1378 from 1475.

. A copy of Form 3115 must also be filed with the IRS. Include a copy of the original return 2. Instructions for Form 8962 - Notices How To Avoid Common Mistakes in Completing Form 8962 Entering amounts from Form 1095-A.

Motor and Alternative Fuel Tax Forms. BUSINESS TAX REPORTING MBT is imposed on the Total Gross Wages including tips as defined in NRS 612190 wages paid for personal services to Unemployment Compensation. Medical Marijuana Tax Forms.

Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter. File Form 3115 in duplicate for an automatic change request. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses.

You can find the appropriate address on Page 3 of the instructions for Form 1120s. It requires data and information you should have on-hand. Youll need to make changes to specific line items showing the original amount the net change and the correct amount using a process similar to the one for Form 1040X.

Whats New Section 179 deduction dollar limits. S Corporation File an amended return on Form 1120s by sending the return along with any schedules that changed to the address where the original S corporation tax return was filed. Fill out Modified Business Tax Return General Businesses Form within a few minutes following the recommendations listed below.

Use this as your opportunity to get. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. The Nevada Modified Business Return is an easy form to complete.

2019 MICHIGAN Business Tax Annual Return. Federal Employer Identification Number FEIN or TR Number Doing Business As DBA 8. To download a PDF copy of the return or order a paper copy through our publication ordering service go to Company tax return 2021.

Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165 For additional questions about the Nevada Modified Business Tax see the following page from the State of Nevadas Department of Taxation. Complete the necessary fields which are yellow-colored. Keystone Opportunity Zone KOZ Forms.

Granholm July 12 2007 imposes a 495 business income tax and a modified gross receipts tax at the rate of 08. Insurance companies and financial institutions pay alternate taxes see below. When and Where to File Form 3115.

Individual Tax Return Form 1040 Instructions. Pick the document template you need from the collection of legal forms. Click on the Get form key to open it and begin editing.

Gross wages payments made and individual employee information. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter.

Issued under authority of Public Act 36 of 2007. The IRS uses your MAGI to determine your eligibility for certain deductions credits and retirement plans. Return is for calendar year 2019 or for tax year beginning.

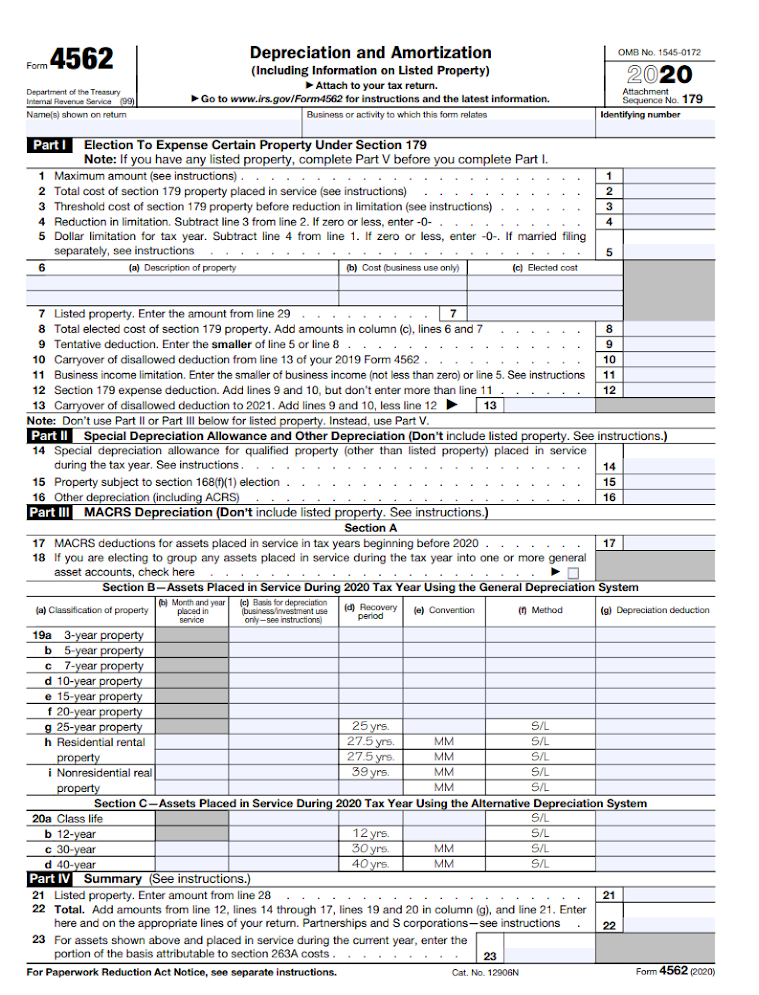

Employer paid health care costs paid this calendar quarter. Instructions for Form 4562 - Introductory Material Future Developments For the latest information about developments related to Form 4562 and its instructions such as legislation enacted after this form and instructions were published go to IRSgovForm4562. Forms and payments must be mailed to the address below.

Malt Beverage and Liquor Tax Forms. A typed drawn or uploaded signature. Needed to file the estate or trust return use Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns to apply for an automatic 5½-month extension of time to file.

The Michigan Business Tax MBT which was signed into law by Governor Jennifer M. Decide on what kind of signature to create. Ad Fast Easy Secure.

Follow the step-by-step instructions below to design your nevada modified business tax instructions. 7 You can apply for a quick refund of estimated taxes for your corporation by filing IRS Form 4466. Taxpayer Name print or type 7.

MAGI can vary depending on the tax benefit. Amended Tax Filing Service. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU.

To amend a tax return for a corporation complete and file Form 1120-X. Attach the original Form 3115 to your federal income tax return for the year of the change including extensions. Instructions for Form 1040.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. Complete all of the necessary boxes they are yellowish. These instructions will help you complete the Company tax return 2021 NAT 0656 the tax return for all companies including head companies of consolidated and multiple entity consolidated MEC groups.

Schedule 1 Part I Schedule 1 Part II Schedule 2. These instructions are based mostly on Regulations sections 11411-1 through 11411-10. There are three variants.

There are no changes to the threshold of the sum of all taxable wages after deductions currently at 50000 or the Commerce Tax credit. You can find this address on the instructions for Form 1065. Use the e-signature solution to add an electronic.

Step-by-step Instructions to Help You Prepare and File Your Tax Amendment. Create your signature and click Ok. You can request approval for a change in accounting methods in one of two ways.

If you dont however have this information readily available this simple form can end up taking hours to complete. The default dates for submission are April 30 July 31 October 31 and January 31. Write the word AMENDED in black ink in the upper right-hand corner of the return.

To communicate amendments or corrections that need to be made on a tax return an amended return must be mailed to the Department reflecting these changes in the following manner. Child tax cedit or the cr edit for other dependents such as the r foreign tax cedit education cr edits or general business cr editr Owe other taxes such as self-employment tax household employment taxes additional tax on IRAs or other quali ed retiement plans and tax-favor ed accountsr. BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU. The tips below can help you fill out Nevada Modified Business Tax quickly and easily. Select the document you want to sign and click Upload.

Who Must File Attach Form 8960 to your return if your modified adjusted gross income MAGI is greater than the applicable threshold amount. Open the document in the full-fledged online editor by hitting Get form. Other Tobacco Products Tax Forms.

Press the green arrow with the inscription Next to move from box to box. Line 3 on the Employers Quarterly Contribution and Wage Report Form NUCS 4072 or UI Nevada system printout NRS 363A130 and NRS 363B110 BUSINESS TAX DEDUCTIONS. Purpose of Form Use Form 8960 to figure the amount of your Net Investment Income Tax NIIT.

How To Complete Form 1120s Schedule K 1 With Sample

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Irs Form 4562 Explained A Step By Step Guide The Blueprint

3 11 16 Corporate Income Tax Returns Internal Revenue Service

2020 Draft Form 1065 Instruction Indicates Changes In Partners Capital Account Reporting Windes

Instructions For Form 1040 Nr 2021 Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

3 12 16 Corporate Income Tax Returns Internal Revenue Service

How To Win The Tax Game And Play Within Its Complex Rules The New York Times

Publication 974 2021 Premium Tax Credit Ptc Internal Revenue Service

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service